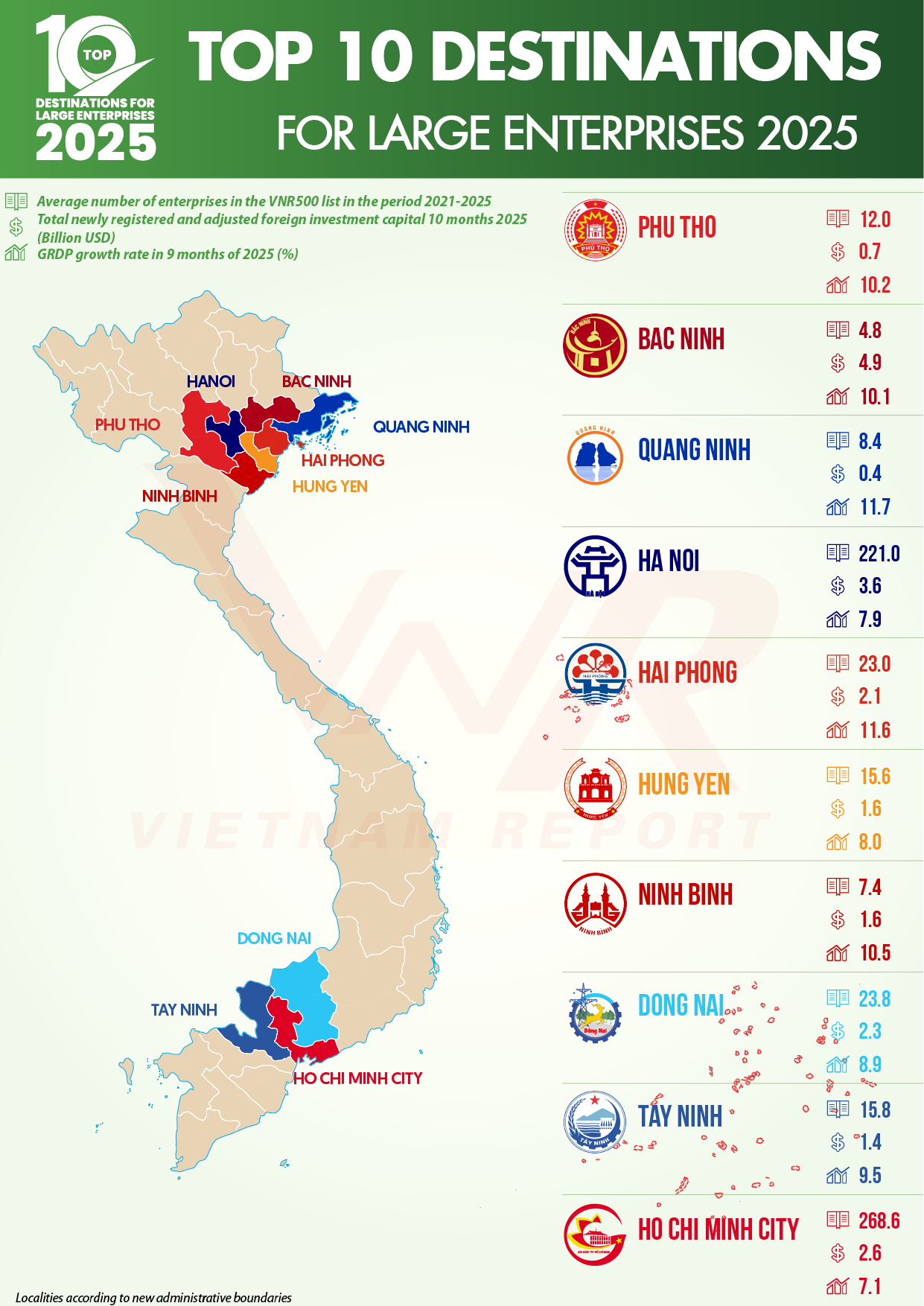

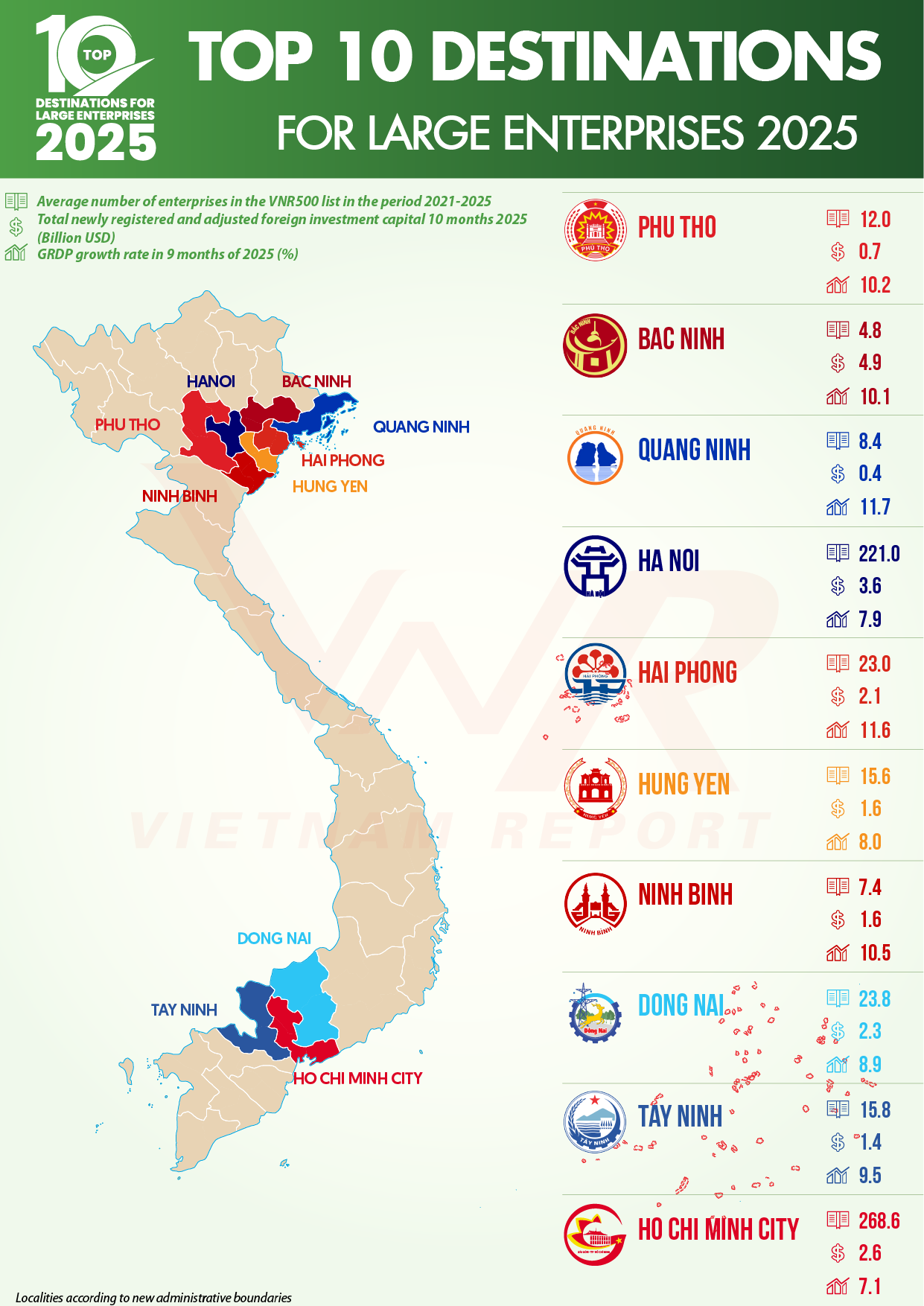

On November 28th 2025, Vietnam Report officially announced the Top 10 Destinations for Large Enterprises 2025, within the framework of the 19th VNR500 Awards honoring the 500 largest companies in Vietnam.

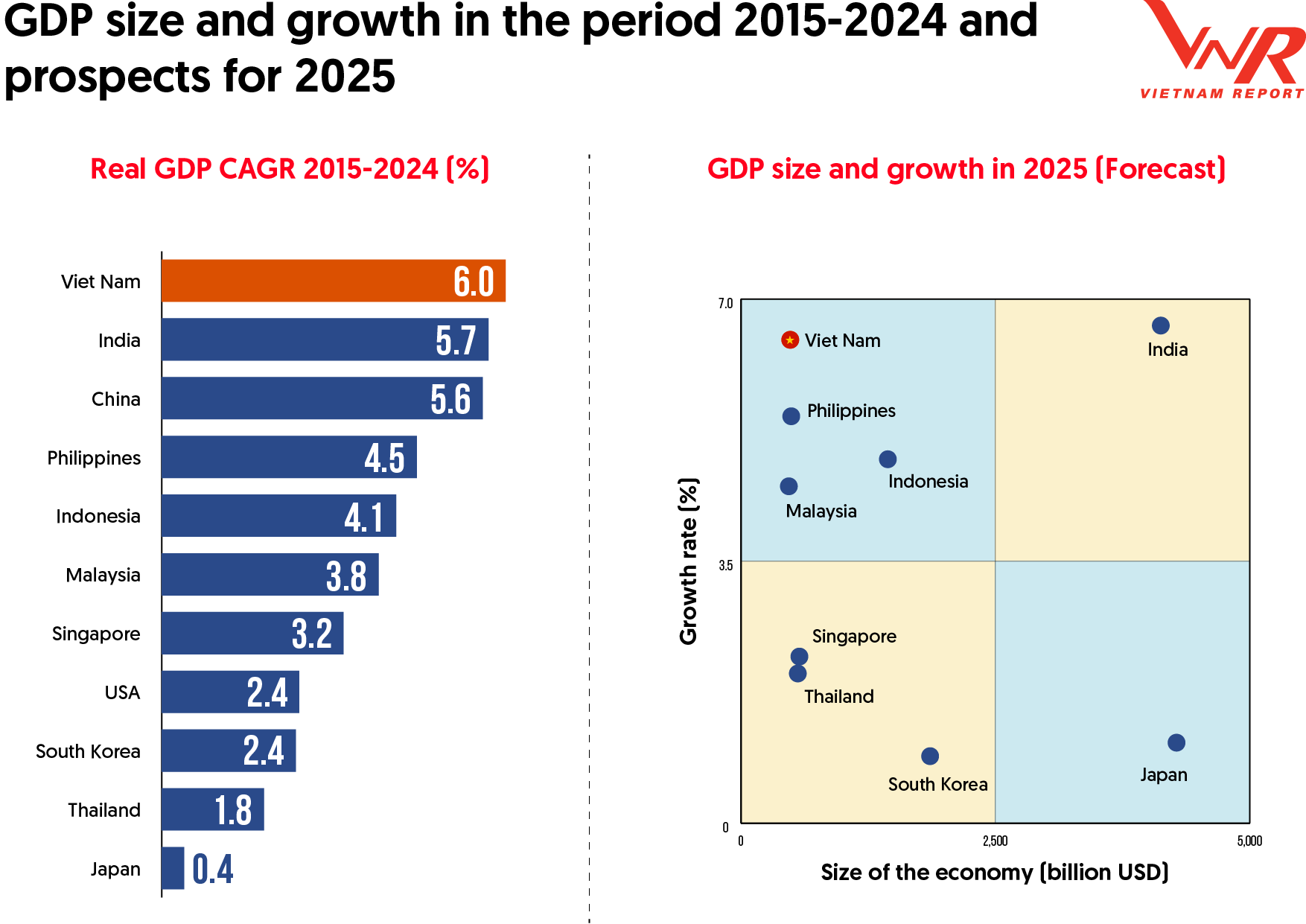

From 2015 to 2024, Vietnam maintained an average GDP growth rate of 6.0 percent, leading the group of major Asian economies. In 2025, Vietnam is forecast to grow by more than 8 percent, reinforcing its position as one of the region’s most dynamic economies.

Source: WB, IMF; Vietnam Report and Boston Report Group compiled and analyzed

As of the end of October 2025, total registered foreign direct investment (FDI) reached 31.52 billion USD, up 15.6 percent year on year. Recent administrative reorganization at provincial and city levels, the formation of larger economic regions, accelerated public investment, administrative reforms, improved logistics infrastructure and digital transformation are all creating new development space for localities across the country.

These forces are paving the way for the emergence of new “strategic landing points” for large enterprises nationwide.

The Top 10 Destinations for Large Enterprises 2025 ranking is built on three main criteria:

- Number of large enterprises (VNR500) locating in the area in the period 2021–2025

- Investment environment and FDI attraction in 2025

- Contribution to national growth

The dataset draws on government management agencies, socio-economic statistics, Vietnam Report’s large-enterprise database and both quantitative and qualitative analysis aligned with international standards.

Source: Vietnam Report and Boston Report Group

Phu Tho: Emerging growth pole in the northern midlands

Source: Vietnam Report and Boston Report Group

Following the recent reorganization of administrative units, Phu Tho is gradually asserting its position as a new growth pole in the northern midland and mountainous region. The province is evolving into a medium-scale industrial center combined with logistics and cultural tourism services.

Phu Tho plays a vital “gateway” role between the Red River Delta and the Northwest, creating a strategic corridor for the movement of goods, labor and services. The province has attracted a number of major players such as Japfa Comfeed, Piaggio Vietnam and AMY GRUPO.

Bac Ninh: Consolidating Vietnam’s “electronics capital”

Source: Vietnam Report and Boston Report Group

The consolidation of administrative units has helped Bac Ninh firmly strengthen its position as Vietnam’s “electronics capital” and a core hub for high-tech industry. Thanks to its strategic location and extensive inter-regional transport infrastructure, Bac Ninh is among the localities most deeply integrated into global technology supply chains within ASEAN.

The province hosts many major corporations and listed firms, including Dabaco, Kinh Bac City Development Holding Corporation and Tonmat.

Quang Ninh: A dynamic coastal growth engine

Source: Vietnam Report and Boston Report Group

With its role as a nucleus for the maritime economy and high-end tourism, Quang Ninh has affirmed itself as one of the most dynamic and influential growth centers in Vietnam.

The province’s transformation over the past decade showcases a development philosophy built on institutional reform. Quang Ninh has led the Provincial Competitiveness Index (PCI) rankings for many years and continues to attract large conglomerates such as Dong Bac Corporation, Calofic and BIM Group.

Hanoi: Core of a new super-urban, super-industrial region

Source: Vietnam Report and Boston Report Group

Beyond its traditional role as the political, economic and cultural capital, post-merger Hanoi has become the coordinating core of a vast super-urban and super-industrial region that stretches into Bac Ninh, Hung Yen and Phu Tho.

This broader region concentrates many of the country’s leading conglomerates such as Petrovietnam, Vingroup and Viettel, along with major clusters of high-tech FDI, large electronics factories and mechanical and automotive plants.

Hai Phong: Production and logistics gateway to the world

Source: Vietnam Report and Boston Report Group

Hai Phong functions as a key production, logistics and export hub for the wider region and a strategic node in international trade flows.

In addition to a modern seaport system, Hai Phong is home to major industrial parks and economic zones such as Dinh Vu – Cat Hai, Trang Due and VSIP, which have attracted numerous global groups including LG Electronics, Ford Vietnam, LS-VINA and Phu Lam Plastic.

Hung Yen: Magnet for supporting-industry enterprises

Source: Vietnam Report and Boston Report Group

Benefiting from its location close to major production centers (Bac Ninh, Hai Phong, Ninh Binh) and strong spillover effects from the expanded Hanoi metropolitan belt, Hung Yen has become one of the most attractive destinations for supporting-industry enterprises.

Representative companies that are helping shape the province’s industrial landscape include Hoa Phat Group, Stavian Chemical and Mavin Austfeed.

Ninh Binh: Balanced three-pillar growth model

Source: Vietnam Report and Boston Report Group

Ninh Binh is gradually repositioning itself as a balanced regional growth pole where manufacturing, eco-tourism and specialized agriculture coexist in a rare and harmonious structure.

Leading enterprises such as Hyundai Thanh Cong, Hong Ha Feed and Nam Ha Pharma exemplify this model. The locality’s “three-pillar” development approach creates stability and strong resilience against economic shocks.

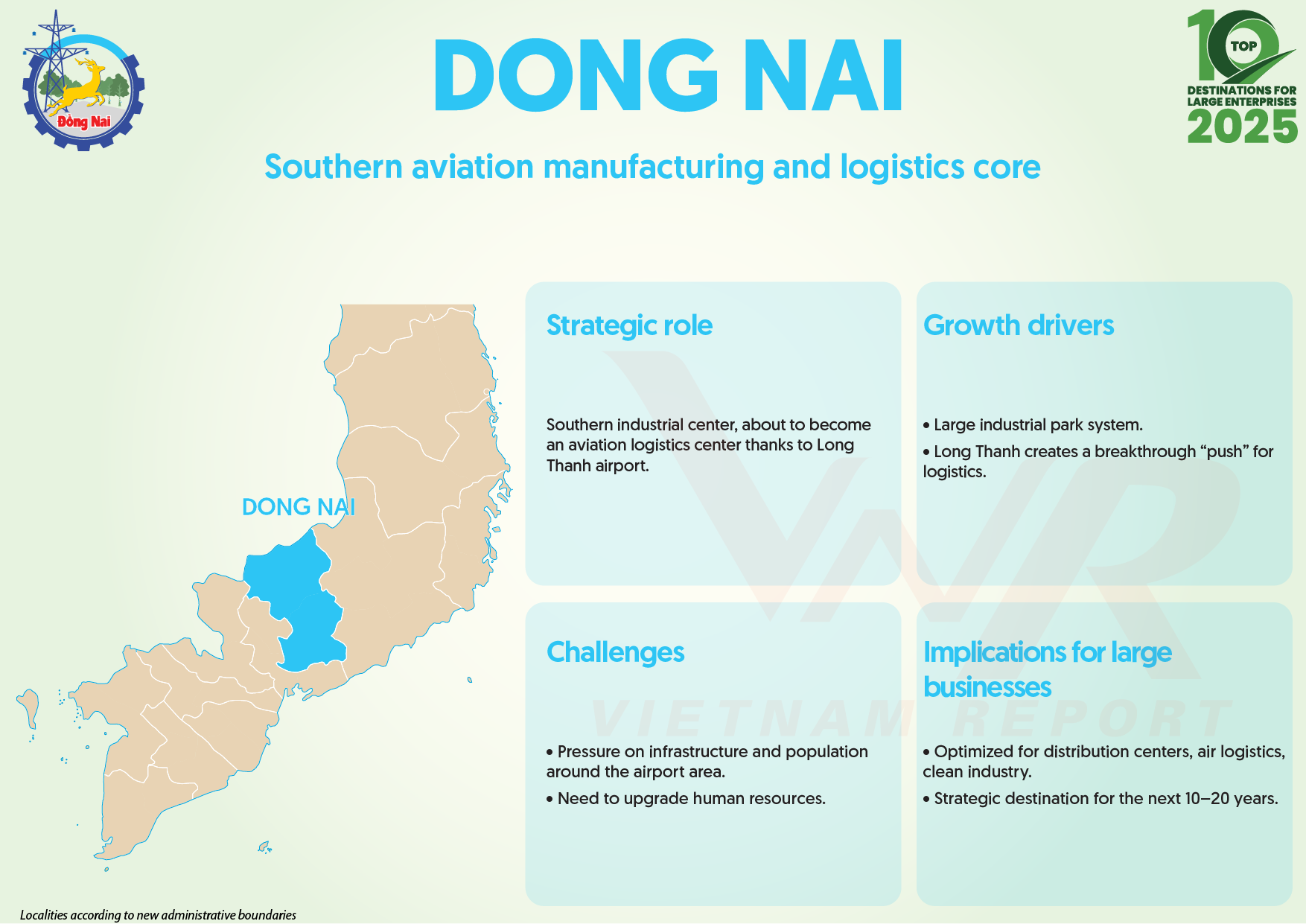

Dong Nai: Diverse corporate ecosystem in the Southern Key Economic Region

Source: Vietnam Report and Boston Report Group

Dong Nai hosts a highly diverse corporate ecosystem. State-owned enterprises such as Sonadezi and Dofico play a central role in developing economic and industrial infrastructure, while large national conglomerates like Tin Nghia and Truong Hai (THACO) and key FDI investors such as Cargill, Nestlé and Sunjin Vina expand the province’s industrial base.

Following administrative reorganization, Dong Nai benefits from a strategic location adjacent to Ho Chi Minh City, helping to form the country’s largest production, logistics and seaport corridor.

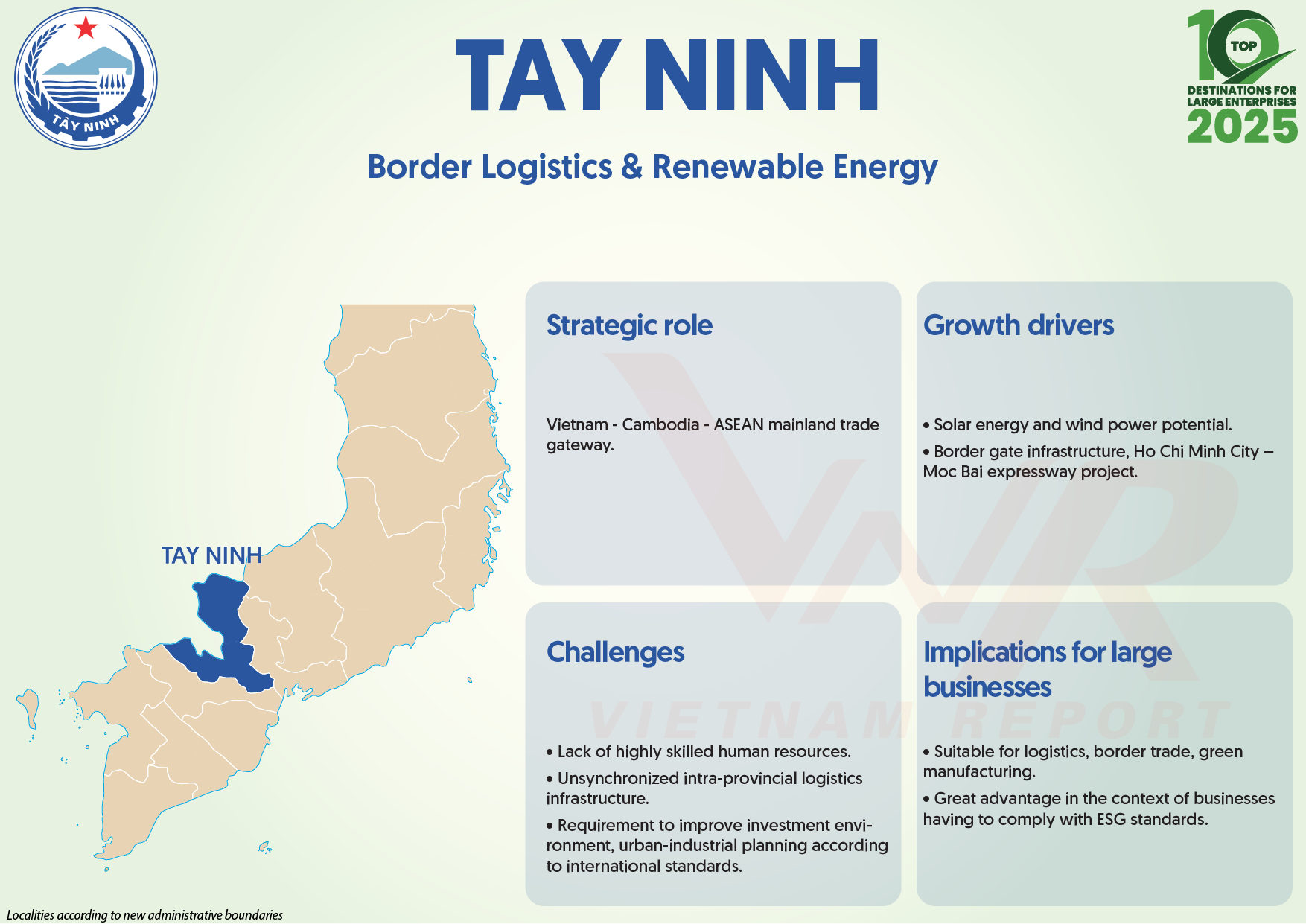

Tay Ninh: From border province to logistics and renewables hub

Source: Vietnam Report and Boston Report Group

Tay Ninh is shifting from a traditional border province into a logistics, trade and renewable energy center with strategic influence. The province has attracted prominent names such as Thanh Thanh Cong – Bien Hoa, Greenfeed and PAN Group.

Tay Ninh is an important link in trans-border supply chains and serves as a “back-up base” that helps Ho Chi Minh City and Dong Nai ease pressure on inner-city infrastructure.

Ho Chi Minh City: Super economic region with outsized influence

Source: Vietnam Report and Boston Report Group

After its recent administrative merger, Ho Chi Minh City has become a “super economic region” with a scale and influence that go far beyond the functions of a traditional core city.

As Vietnam’s largest financial and services center, Ho Chi Minh City is a key destination for FDI, a leader in business innovation and a provider of strategic human resources. The city continues to attract many of the country’s largest enterprises, including Vinamilk and Masan Group.

From individual provinces to regional growth ecosystems

In the coming decade, Vietnam’s growth is expected to be driven more by regional growth corridors than by isolated provinces. The location choices of large enterprises already reflect a shift toward regional ecosystems, where each locality plays the right role and creates the right type of value within a larger network.

The Top 10 Destinations for Large Enterprises 2025 can be viewed as a “strategic map” of the places that will shape Vietnam’s economic future in a new era, defined by proactive reform capacity, regional connectivity and the redefinition of growth models.

A more detailed profile of each locality in the Top 10 is published on the official website of Vietnam Report.

Boston Report Group